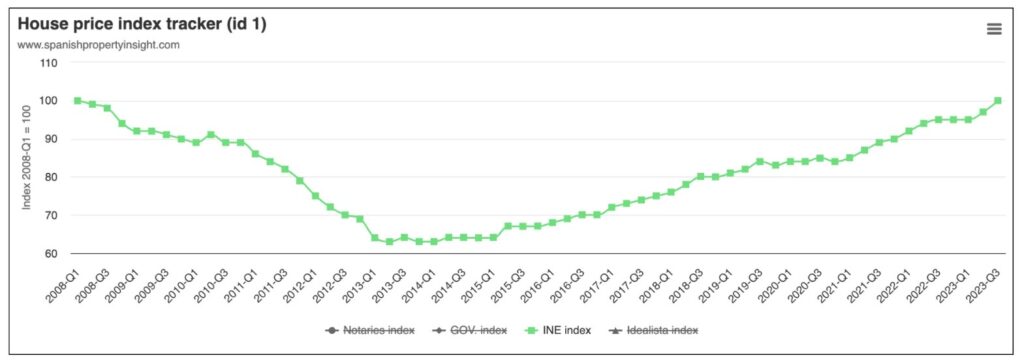

Recently published data from the National Institute of Statistics (INE) on Spanish house prices in the third quarter of last year shows that prices are recovering to 2008 levels, at least in nominal terms.

It took fifteen years for the average Spanish house price to return to the level of the end of the last boom, according to the latest Spanish house price figures from the INE, as illustrated in the graph above.

Although the average Spanish house price in nominal terms has recovered to the level of fifteen years ago, the average price in real terms (adjusted for inflation) is still 35% below the level of the first quarter of 2008. Prices have risen 50% in nominal terms since 2015, but anyone who invested in the bubble period that was already deflating in 2008 is likely still harboring negative equity.

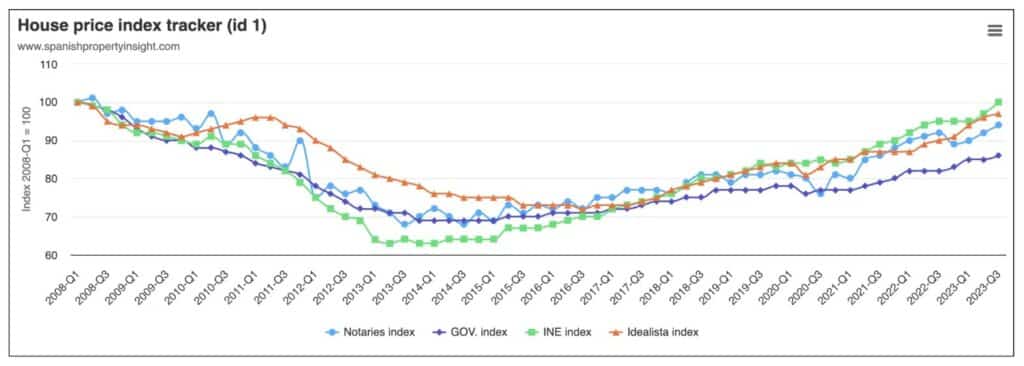

Moreover, the INE house price index is the only one that has finally regained all the ground it had lost since 2008. The other most viewed indices published by the Ministry of Housing, the notaries and the real estate portal Idealista (asking prices) are still below where they were fifteen years ago, as you can see in the following graph.

Regional differences.

The INE publishes a property price index for Spain as a whole, plus indexes for each of Spain’s autonomous regions. Although Spain as a whole is back to the levels of fifteen years ago, prices are higher in Andalusia, the Balearic Islands, the Canary Islands and Madrid, but still lower in the Valencia region, Catalonia and Murcia.

Source: www.spanishpropertyinsight.com